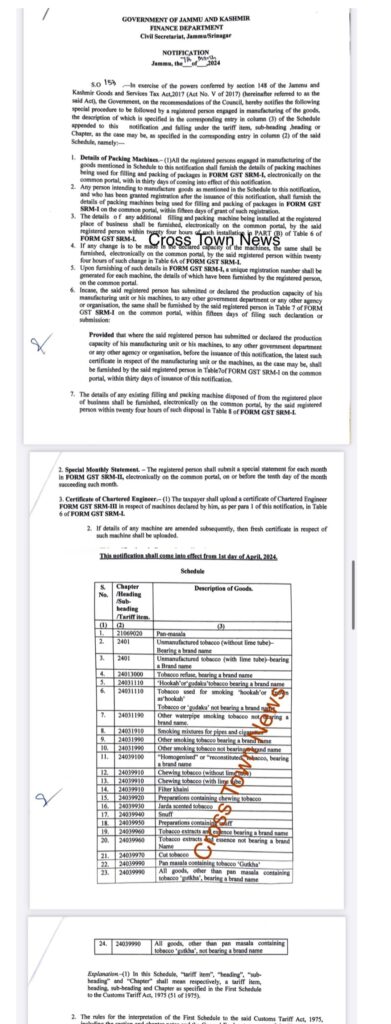

The Government of Jammu and Kashmir has issued a notification concerning the implementation of a special procedure for registered persons engaged in the manufacturing of specified goods under the Jammu and Kashmir Goods and Services Tax Act, 2017 (Act No. V of 2017). This notification mandates compliance with certain requirements and introduces new reporting protocols for registered manufacturers.

Details of Packing Machines

Manufacturers must now provide detailed information about their packing machines. These details must be submitted on FORM GST SRM-I through the common portal. Existing manufacturers have thirty days from the notification’s coming into effect to comply, while new manufacturers must submit these details within fifteen days of obtaining their GST registration.

Registration of Machines

Each packing machine will receive a unique registration number upon submission of the required information. If there are any changes, such as the installation of additional machines, the registered person must update the details within twenty-four hours of the change.

Special Monthly Statement

Manufacturers are also required to submit a monthly statement in FORM GST SRM-II for each machine. This statement must be submitted on the common portal by the tenth day of the month following the month being reported.

Certificate of Chartered Engineer

A certificate from a Chartered Engineer must be uploaded to the common portal for every machine declared in the FORM GST SRM-I. If any machine’s details are later amended, a new certificate reflecting the changes must be uploaded.

The notification will be effective from the 1st of April, 2024. This allows ample time for manufacturers to adapt to the new requirements.

Schedule of Goods

The schedule appended to the notification lists various tobacco products ranging from unmanufactured tobacco with or without a brand name, hookah tobacco, snuff, chewing tobacco, and pan-masala containing tobacco ‘Gutkha’, among others. Each product is classified under a specific tariff item, heading, sub-heading, and chapter as per the First Schedule to the Customs Tariff Act, 1975.

Explanation and Interpretation

The terms “tariff item,” “heading,” “sub-heading,” and “Chapter” are to be interpreted as defined in the Customs Tariff Act, 1975.

The notification aims to streamline the reporting process and ensure manufacturers comply with the GST regulatory framework. These measures reflect the government’s commitment to enhancing transparency and accountability in the tax system.